The Single Strategy To Use For Square Credit Card Processing

Wiki Article

Our Comdata Payment Solutions Statements

Table of ContentsThe Virtual Terminal Ideas4 Simple Techniques For Virtual TerminalExcitement About Square Credit Card ProcessingIndicators on Payment Solutions You Should KnowCredit Card Processing - The FactsHow Clover Go can Save You Time, Stress, and Money.The Ultimate Guide To Credit Card Processing Fees

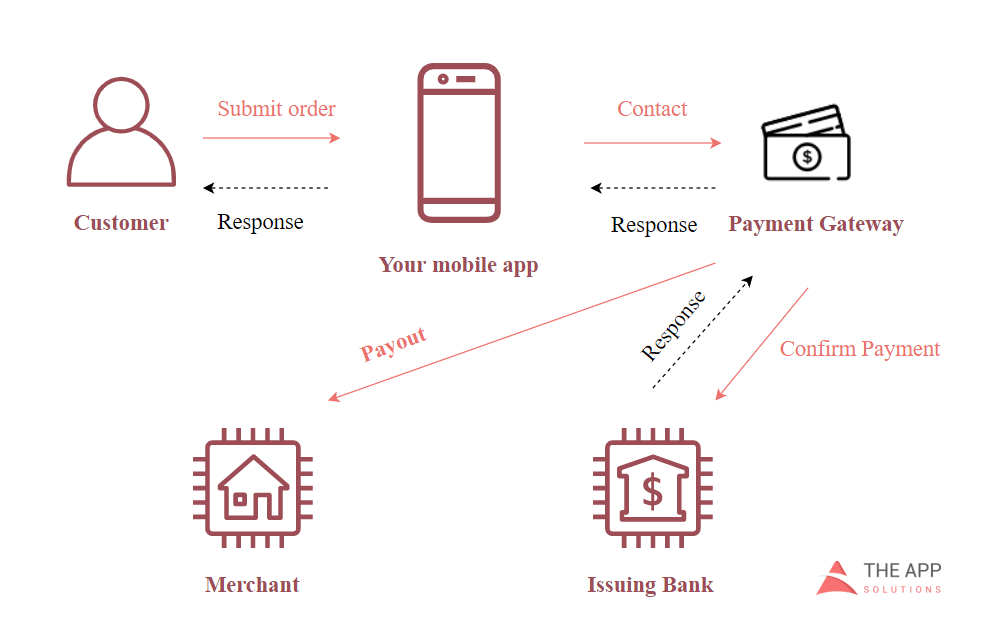

comparable to refund yet can be done if funds were not yet recorded. Repayment handling flow The framework of on-line repayment processing is a bit much more complex than you may picture. For the customer, it's stood for by a small window, or a different internet site, where they have to go through the check out.Purchase standing is returned to the settlement portal, after that passed to the web site. A client obtains a message with the purchase standing (accepted or rejected) by means of a repayment system user interface. Within a number of days (normally the next day), the funds are transferred to the merchant's account. The purchase is performed by the providing bank to the getting bank.

Currently we are relocating closer to settlement portals in their selection. To integrate a settlement system into your internet site, you will need to comply with several steps. Settlement portal integration Generally, there are four major approaches to incorporate a settlement portal. All of them vary by two significant variables: whether you must remain in conformity with any type of monetary policy (PCI DSS), and the level of individual experience concerning the check out and also repayment procedure.

What Does Clover Go Do?

What is PCI DSS compliance and also when do you require it? In case you simply require a repayment gateway remedy and also do not plan to shop or process charge card data, you might skip this area, since all the processing and also regulative burden will be accomplished by your gateway or repayment company. credit card processing.is a needed aspect for processing card payments. This protection requirement was created in 2004 by the four biggest card associations: Visa, Master, Card, American Express, and also Discover. To become PCI compliant, you will certainly have to finish 5 actions:. There are 4 degrees of compliance that are determined by the variety of safe purchases your organization has actually completed.

More About First Data Merchant Services

Given this information, we're mosting likely to look at the existing integration options and also clarify the benefits and drawbacks of each. We'll additionally concentrate on whether you have to follow PCI DSS in each instance as we describe what assimilation methods match different kinds of businesses. Held gateway An organized repayment portal acts as a 3rd party.Essentially, that's the situation when a client is rerouted to a settlement gateway website to enter their bank card number. When the transaction data is sent, the customer is rerouted back to the vendor's page. Here they complete the check out where deal authorization is shown. Held payment gateway work scheme of a held payment portal are that all payment handling is taken by the provider.

Making use of a hosted entrance requires no PCI compliance and offers quite easy combination. Consumers may not trust third-party settlement systems.

Our Payment Hub Ideas

Pay, Friend Check Out suggests combination in the form of a Smart Payment Switch. Basically, it's a piece of HTML code that implements a Pay, Buddy switch on your check out page. It invokes the Pay, Chum Remainder API telephone calls to validate, gather, as well as send out settlement info through a portal, whenever an individual sets off the button.Straight Message approach Straight Post is an integration approach that enables a client to store without leaving your site, as you do not need to get PCI compliance. Straight Message assumes that the deal's data will be posted to the repayment gateway after a client clicks a "acquisition" switch. The information immediately gets to the entrance and cpu without being stored by yourself server.

This is essentially a prebuilt gateway that can be personalized as well as branded as your own. Right here are some well-known white tag options created for sellers: An incorporated entrance can be a devoted source of revenue, as sellers that get all the needed compliance end up being settlement company themselves. This implies your organization can refine settlements for other sellers for a charge.

Some Known Details About Square Credit Card Processing

You can customize your settlement system as you wish, and also tailor it to your service requirements. In case of a white-label service, the payment entrance is your top quality innovation.Here are some points to think about before selecting a provider. Research the rates Repayment handling is complicated, as it consists of a number of banks or companies. Like any type of service, a repayment gateway calls for a fee for utilizing third-party tools to procedure and authorize the deal. Every party that joins repayment verification/authorization or handling costs charges.

Every repayment option provider has its own terms of use as well as fees. Usually, you will have the adhering to cost kinds: gateway setup cost, monthly entrance fee, seller account configuration, as well as a charge for each transaction refined.

Ebpp Things To Know Before You Get This

This is check out this site generally a prebuilt portal that can be tailored and also branded as your very own. Right here are some widely known white tag remedies developed for merchants: An incorporated portal can be a specialized resource of profits, as sellers that obtain all the essential conformity become settlement service providers themselves. This indicates your organization can process repayments for various other vendors for a cost.are that you have full control over the deals at your website. You can tailor your repayment system as you want, and wikipedia reference customize it to your service needs. In case of a white-label remedy, the settlement portal is your branded innovation. typically are everything about maintaining the framework of your repayment system and the relevant expenditures.

The Best Strategy To Use For Virtual Terminal

Every payment service provider has its own terms of use and also charges. Normally, you will have the following cost kinds: gateway setup fee, try this out month-to-month portal cost, vendor account setup, and a fee for each purchase processed.Report this wiki page